Key Insights from Newspapers’ Black Friday Deals in 2023

2023 marks the third year Twipe analyses publishers’ Black Friday offers. Our focus remains consistent with last year’s, involving an in-depth examination of the same 60 publications we studied in 2022. This approach benchmarks year-on-year changes and provides insights into the strategic adaptations publishers are making in this key sales period.

Innovative Strategies: Enhancing Subscriptions Beyond News

Content remains central to publishers’ offerings throughout the year, yet the way in which its packaged is what was on offer this Black Friday. With the ever-decreasing revenue of physical newspapers for most publishers, it’s little wonder that most promotions are for digital formats like ePapers, live news apps, and web access.

It is interesting to note that publishers supplemented their subscriptions with extras like access to audio features, games and puzzles, and exclusive newsletters. Bundled services were also offered by leading names such as The Wall Street Journal, New York Times, Aftonbladet, Svenska Dagbladet, and Gazzetta dello Sport providing access to a variety of magazines and unique products.

Other innovative strategies to enhance subscription value were also evident this year, such as:

- Community access: Publishers such as Le Figaro, El País, Die Welt offered the ability to comment on articles as a subscriber-exclusive feature.

- Account sharing: Enabling account sharing with additional users could potentially attract a younger demographic who might access news through a parent’s account, as is often done for other subscription services (e.g. Spotify and Netflix).

- Level of analysis: Danish publisher, Børsen, differentiated itself by providing enhanced levels of journalistic analysis as part of its subscription tiers.

- Ad-free reading: The strategy of offering ad-free reading environments underscores a commitment to user experience.

- Ecommerce site discounts: Several publishers have expanded into the ecommerce sector, offering Black Friday discounts on their ecommerce platforms, thereby blending traditional news content with modern retail opportunities. Notable examples include The Independent, Kronen Zeitung and El País, among others.

- Access or discount on events: We’ve observed a growing trend of publishers of organising their own events. This was reflected in the discounts from The Telegraph, the Boston Globe, Le Parisien, and Frankfurter Allgemeine Zeitung who offered special pricing for events to subscribers.

Methodology

This article analyses Black Friday deals offered by 60 notable newspapers globally, comparing the prevalence and nature of these deals over the past two years.

Newspapers from different regions and varied pricing tiers were selected. Special Black Friday offers were only considered if marketed as such (“Black Friday,” “Black Week,” or “Black Month” on the newspapers’ websites). Publishers with permanently discounted prices were excluded. We selected the “digital access” tier or closest when publishers offered discounts at different tiers.

To account for different currencies and lengths of subscription discounts, we standardized the prices to reflect a monthly price in Euros. While an imperfect method of comparison, it still provides interesting indicators on pricing strategies. The analysis centered on discounted pricing tiers, the discount percentage change, and the geographical distribution of offers.

Of course, one must remember that the study’s scope was confined to a selected number of newspapers and may not represent all global publishing strategies.

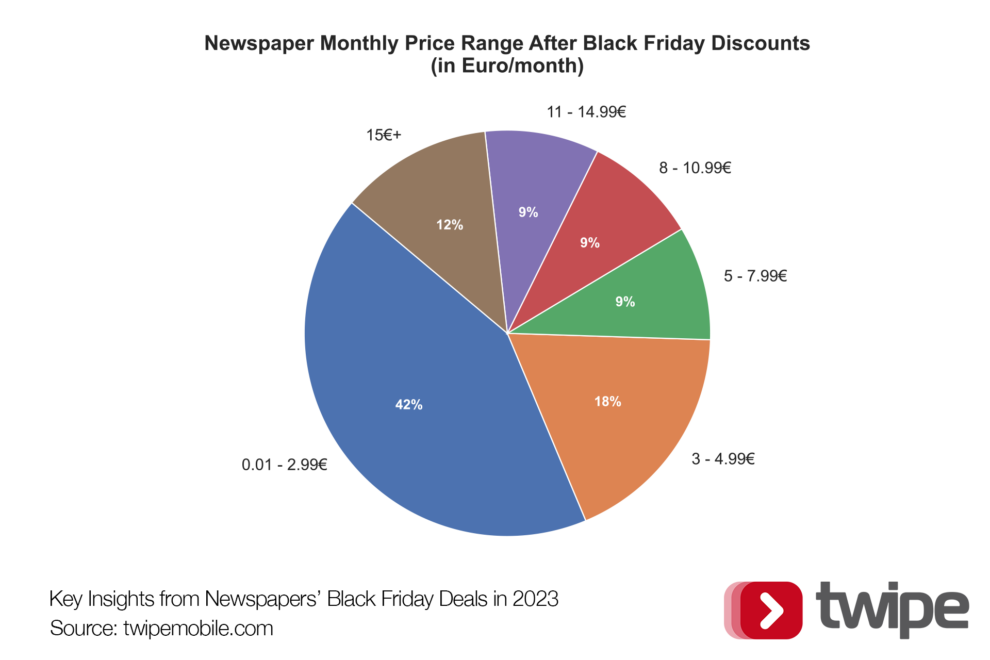

Understanding Publishers’ Discounting Tactics

Considering one of the main reasons cited for not subscribing to a news outlet is the high price, it comes as no surprise that publishers offed significant discounts this Black Friday. Like last year, the most common discounted price range was 0.01 – 2.99€ per month. The presence of a substantial number of publishers in the lowest discount bracket could reflect a strategy to convert free readers into paid readers by easing them in at a low price point, leveraging the power of habit formation to convert them to higher tiers at a later stage.

Similarly, several publishers – from the Japanese, Asahi Shimbun, to the Swedish, Dagens Nyheter – offered free months so that readers could try before buying in at a discounted or normal subscription rate. Both a free trial and a price point under 5€ notably appeal to younger audiences, which may help explain the popularity of both offerings.

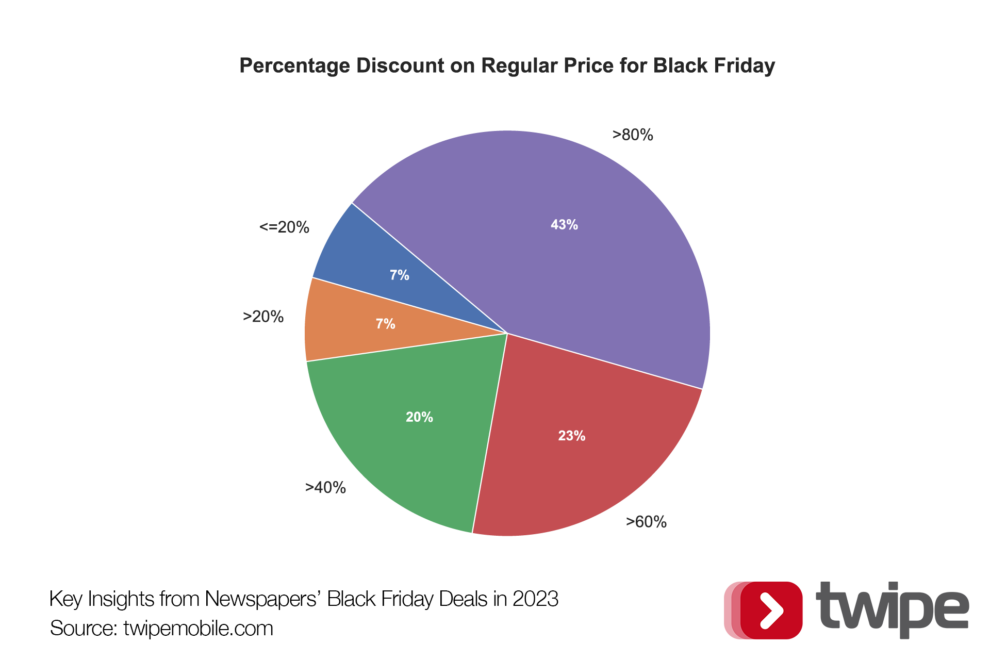

In line with the heavily discounted price range, Black Friday discounts ranged from 7% to 99% of the normal price of a subscription. We found that a plurality of publishers offered discounts greater than 80% off their normal price per month. This indicates a highly aggressive discounting strategy, suggesting that these publishers are potentially seeking to significantly grow their subscriber base with the hope that a fraction remain paying customers beyond the length of the offer.

The 15€+ price category, though not the most common, was still used by 12% of the publishers studied. Those in this bracket may be aiming to highlight their premium nature to potential subscribers, either by offering premium content (e.g. Børsen offering different pricing based on the level of journalistic analysis) or relying on their quality brand recognition (e.g., Il Sole 24 Ore as the leading financial newspaper in Italy). Interestingly, out of the four publishers in this category, two were German where the price of the ePaper is significantly higher than in other markets. As a result, even a discount on their ePaper product would remain over the 15€/month mark.

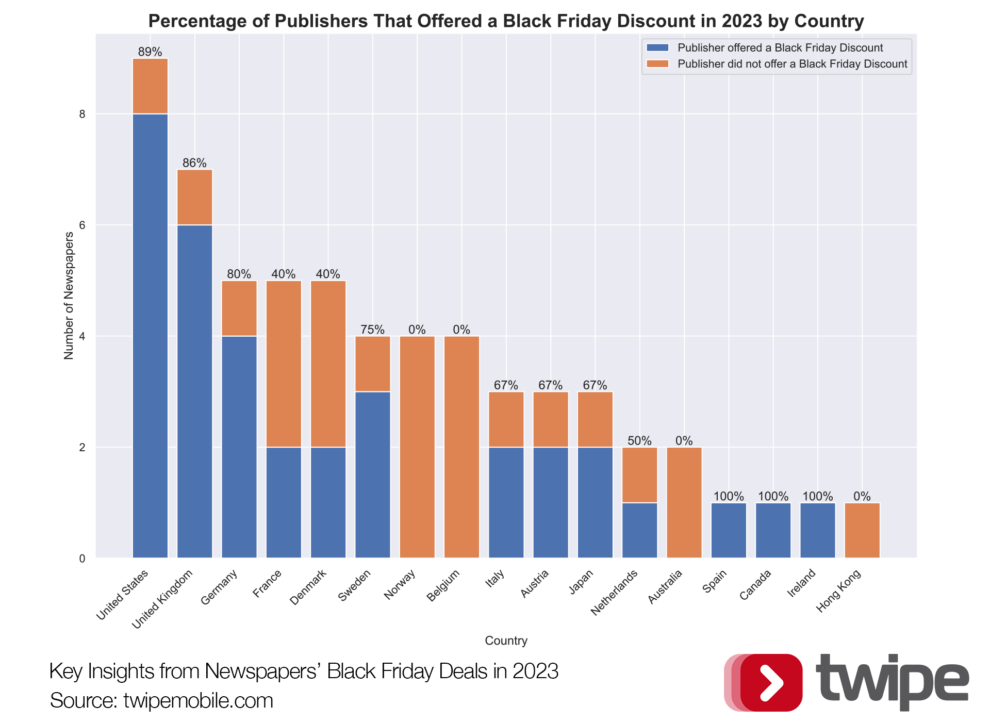

Global Perspective: Who’s Embracing Black Friday Discounts?

Publishers from the UK and US, together with Germany, are more likely offer a Black Friday discount from our sample of 60 publishers. This year no publisher from Norway, Belgium and Australia offered a Black Friday discount.

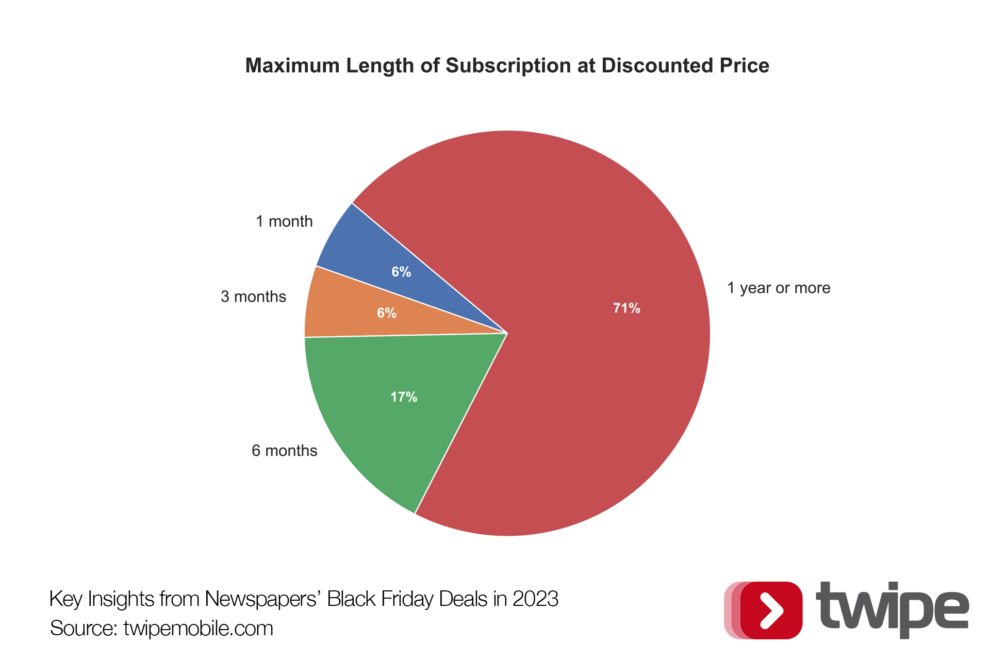

70% of publisher offer a year-long discount

To evaluate the average length of subscription offers, we collected publishers’ longest Black Friday subscription deals. 71% of publishers provided discounts on annual subscriptions or longer, while for 29% of publishers the longest discounts period was less than a year.

This strategy aligns with psychological insights on habit formation, which suggest it takes an average of 66 days to establish a new routine. By promoting longer subscription terms, publishers are tactically allowing themselves an extended window to engage subscribers, enhance their experience, and solidify a habit of consuming their content.

That’s not to say that engagement within a smaller time period isn’t crucial; the first 30 days are a make-or-break period for fostering subscriber habits. If readers do not find immediate value in their subscription, they are less likely to return, impeding the habit-forming process.

The implications of offering yearly subscription discounts are twofold. Firstly, it communicates confidence in the product’s value, betting on the fact that consumers will desire and benefit from a year-long commitment to premium content. Secondly, it reflects a commitment by the publisher to invest time and resources into ensuring subscribers become active, habitual users of their platform, thereby increasing the likelihood of retention and long-term loyalty.

Comparing 2022 vs. 2023 Black Friday Offers: What can we learn?

Our year-over-year findings reveal a slight change in the landscape of publishers offering a Black Friday discount: out of the 60 publishers, 35 offered Black Friday sales, a minor decrease from the 37 observed last year.

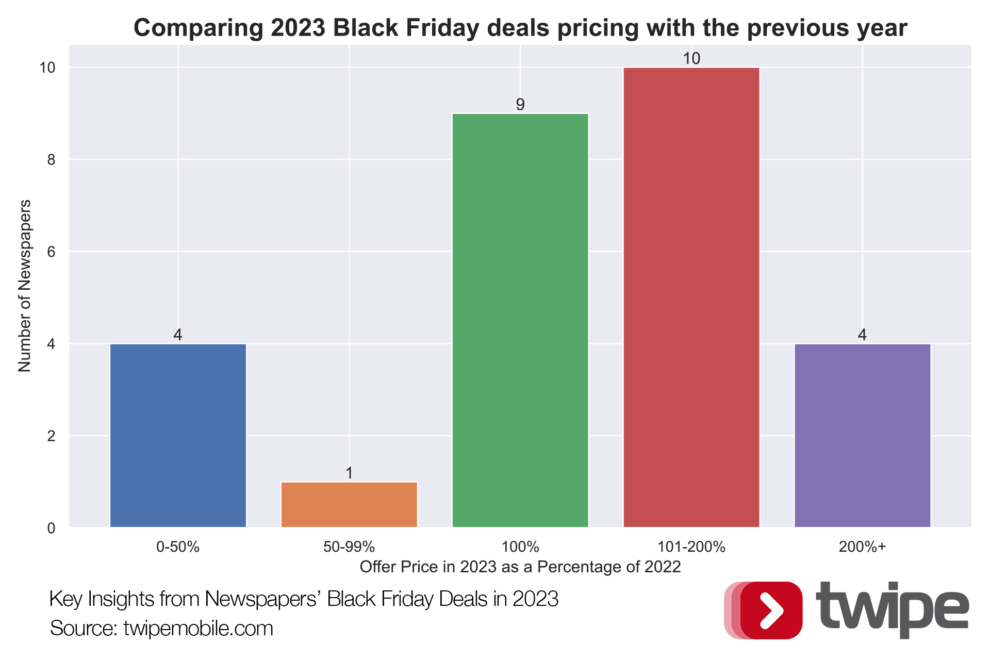

Just over 30% of publishers offered comparable rates compared to last year. Publications such as El País have stood out by adopting a more affordable offering, potentially seeking to capture a wider audience. Conversely, 50% of publishers have increased their base discount prices, a trend that reflects a broader economic narrative, with inflation, production costs and the value of content on an upward trajectory.

Similar to last year, the widespread practice of luring in customers with attractive “freebies” or products unrelated to the publisher’s offering has been sparse. The Daily Mail remained an exception, incentivising subscriptions by integrating Nectar Points, thus tapping into the established loyalty card scheme prevalent in the UK. Similarly, Frankfurter Allgemeine Zeitung offered the allure of a prize draw of electronics for new subscribers. These incentives represent a strategic effort to incentivize potential subscribers, but their rarity also underscores a possible shift in industry focus towards value-driven rather than incentive-led subscription models.

Conclusion

To wrap up this article, our analysis of the 2023 Black Friday deals in the newspaper industry reveals a few key trends:

- Publishers are focused on increasing the value of their products and brands: The sparse use of freebies or unrelated products as incentives suggests a focus on the inherent value of publisher’s content and services to attract and retain subscribers. Publishers can create this value by enhancing their product offerings (e.g. games, newsletters, level of analysis, etc.) or by creating exclusive communities for their subscribers.

- Publishers are casting a wide net to try to convert anonymous readers into subscribers: The prevalence of significant discounts, especially in the cheapest range, suggests a strategic push to convert free readers into paid subscribers, even if only a small percentage will renew their subscription.

- Overall, Black Friday discounts seem to be a popular strategy to attract subscribers: The number of publishers offering Black Friday discounts has remained stable, indicating that publishers are still keen to take advantage of this key sales period.

Other Blog Posts

Stay on top of the game

Join our community of industry leaders. Get insights, best practices, case studies, and access to our events.

"(Required)" indicates required fields